The birth of an underwriting society

Part I

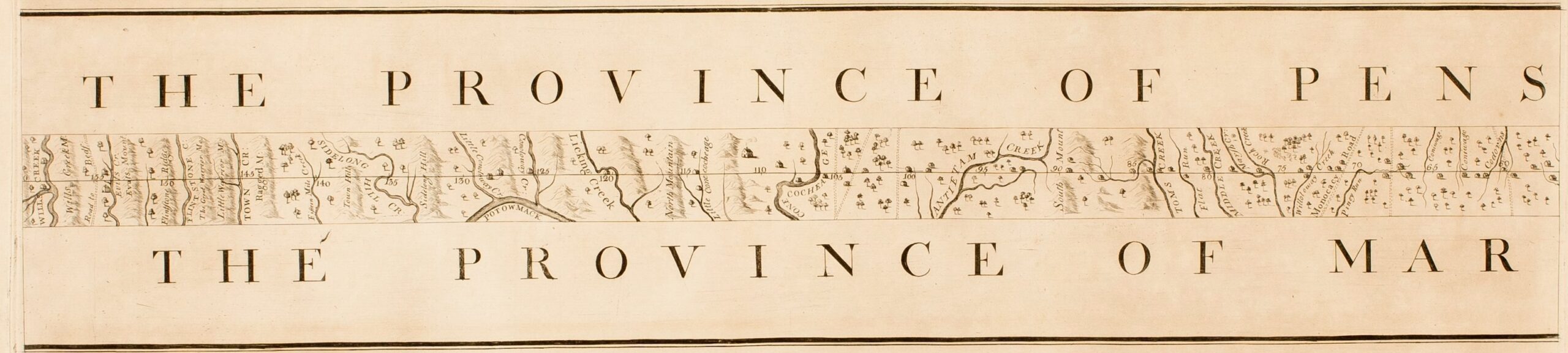

In early June of 1721, near Penn’s Landing in Philadelphia, John Copson became the first American to open an insurance office. Strictly speaking, Copson was a broker of marine policies, decreasing the costs of bringing buyers and sellers of insurance (also called “assurances”) together. The role meant that he was responsible for a more complex and more historically revealing array of services than one might suppose. Like other perceptive businessmen of his time, Copson was adept at capitalizing on new arenas of self-promotion—particularly pubs, coffee and tea houses, and the newspaper. Moving from these venues, Copson became a clearinghouse of social assurances, representing as he says, the “integrity” and “reputation” of the underwriters “in this city and province” to prospective policyholders.

In so doing, he marketed a product that helped to define and broaden what it meant to be both civic-minded and self-interested. This was because Copson’s market can be seen, depending on how one chooses to analyze it, as a function of the republican world of public service or as a product of the growing world of self-aggrandizing commerce. And it can be viewed in both these ways because of the conceptual peculiarities of insurance itself. Insurance—as we see played out in post-Katrina debates about public responsibilities versus private capabilities—has always resisted its formulation as an exclusively private or public method of improvement and safety. It is of service to neither individuals nor to society, but rather to both. Insurance may protect the distinct interests of property owners; but at the same time, it saves society from the costs of failure and destitution. Copson implied as much in an advertisement from the May 25, 1721, American Weekly Merchant.

Assurances from Losses happening at Sea ect. [sic] being found to be very much for the Ease and benefit of the Merchants and Traders in general, and whereas the merchants of this city of Philadelphia and other parts, have been obliged to send to London for such Assurance, which has not only been tedious and troublesome, but even very precarious. For remedying of which, An Office of Publick Insurance on Vessels, Goods and Merchandizes, will, on Monday next, be Opened, and Books kept by John Copson of this City, at this House in the High Street, where all Persons willing to be Insured may apply: And Care shall be taken by the said J. Copson That the Assurors or Underwriters be Persons of undoubted Worth and reputation and of considerable Interest in this City and Province.

One is struck by the term “public insurance.” To the contemporary ear, the phrase might sound contradictory, suggesting a quaint and outmoded notion of common welfare. But it does the important work of bridging private interests and public virtue in a way that seemed quite natural to Copson and his customers.

That customary connection fostered significant changes to many social and cultural practices of colonial America. For instance, the discourse of safety pioneered by the insurance industry brought about important transformations in urban design, architecture, and public health. The assurances of underwriting derived from forms of public knowledge (from actuarial statistics to commercial news) and law (from contract theory to municipal fire codes) that contributed in turn to the conservation of private property. With the impetus of insurance and its private methods of managing property, government saw fit to promote public infrastructure projects that provided shipping and trade amenities—roads, harbors, and wharves—all of which made cargo shipping and early industrial equipment safer and more efficient.

Part II

Like the story of John Copson’s waterfront office, the broader history of the insurance business in colonial America appears deceptively informal. But beneath that informality, so typical of early modern business, lies the rise of an effective and powerful industry that would shape America’s national finances.

Insurance underwriting began its colony-wide rise in the northeast as a result of the growth of transatlantic shipping. While Copson was the first to open a marine insurance office, he was soon followed by others including Francis Rawle, Joseph Saunders, and John Kidd. Kidd was one of six members of the partnership agreement of the first American marine insurance company with “surviving bylaws,” drawn up in Philadelphia toward the end of the 1750s. That company included in its list of partners Thomas Willing, who would go on to be president of the Bank of North America and the First Bank of the United States, and Robert Morris, the superintendent of finance for the Continental Congress.

At midcentury, the hub of underwriting in Philadelphia had become the London Coffee House on the banks of the Delaware River, close to Penn’s Landing. “By 1758,” historian Mary Ruwell notes, “the Insurance Office at the Coffee House had two clerks on duty every day from noon to one and from six to eight at night to take care of writing out policies of insurance and securing underwriting signatures . . . [B]y the end of the eighteenth century, Philadelphia merchants had used the services of at least 150 private underwriters subscribing in about 15 insurance brokerage offices.”

Boston’s marine insurance scene began not long after Philadelphia’s. Joseph Marion, a notary, opened an agency in 1724, thereby breaking free of the coffee house “office.” In the beverage-free office, Marion retained the relatively low-pressure method of linking underwriters with vessel owners: the policy was left on a table for underwriters to pursue as they wished. What Marion pioneered was a kind of full-service emporium where insurance buyers and underwriters could meet and do business.

Marion was still in business as late as 1745, though there is scant evidence to establish just how substantial his business was. Benjamin Pollard opened an office in Boston in 1739 with the innovative practice of systematically procuring the underwriters and their capital in advance, rather than waiting for the random connections that happen in the coffee-house or pub settings. Pollard’s unique service was to forge commercially branded intellectual and civic connections, demonstrating just how powerfully knowledge and social capital became the foundation of insurance underwriting.

Perhaps the most successful Boston underwriter in the pre-Revolutionary period was Ezekiel Price. A notary like Pollard and Marion, Price is described by historian William Fowler as “the archetypal insurance man—he knew everyone and everything.” In colonial New York City, it was the Beekman family that pioneered marine insurance. Already important merchants, the Beekmans saw marine underwriting as a profitable and somewhat logical diversification. Their prior mercantile activities meant that they were comfortable in all aspects of the business, acting as brokers, consumers, and underwriters.

Colonial American fire insurance is a newer phenomenon, beginning its development in the mid-eighteenth century. Part of the reason the business took longer to evolve was the longevity requirements of a credible fire insurance business. Unlike ship underwriting, which could be sustained by loose networks of underwriters and which insured ships that could complete their voyages in weeks or months and thus complete the term of the policy, fire insurers underwrote houses and buildings, which could ride out the terms of a policy over the course of decades. Firms needed to be well capitalized and less partner driven, which is why mutuals (in which the policyholders are also the owners of the company) were often the best form for fire-insurance concerns.

The first mutual society in the colonies was established in Charleston in 1735 and was called the Friendly Society. The private underwriters were unable to build adequate reserves, and in 1741, a large fire wiped out the firm. The first truly successful fire-insurance company was Benjamin Franklin’s Philadelphia Contributionship, begun in 1751 and, by 1781, responsible for about two thousand policies worth almost $2 million. Fire insurance companies were more likely than banks to have substantial cash reserves, allowing them to play a vital role as lending institutions, funding both private and public enterprise.

By the middle of the eighteenth century, American insurance underwriting was becoming a relatively prosperous industry. But, despite the growth of the underwriting business in Philadelphia, and indeed the colonies at large, the bulk of the colonial underwriting business continued to go to London’s better-financed companies. Monetary capital, in the form of the numerous individual underwriters to be found in a place like Lloyd’s Coffeehouse, was just too scarce in the colonies.

This changed by the 1790s for a number of macro- and microeconomic reasons. The essential components of thriving underwriting communities, what Fowler refers to as “information, capital, and men willing to act as underwriters,” reached critical mass in the 1790s. This development was of a piece with Alexander Hamilton’s successful efforts to establish national capital markets through the Bank of the United States, the extension of new forms of credit, and the first steps in centralizing the national monetary system. Insurance companies were no less important than banks in this nationalizing of capital markets and the building up of a healthy belief in solid credit instruments.

In short, insurance underwriting gained influence in the political and cultural development of the new nation because it became a primary source of finance capital. Once capital markets began depending on the business for credit, insurance companies were able to write riskier policies and expand into new insurance markets.

If there was an easy congruence between the needs of capital markets and the inherent fundraising capacities of fire and marine insurance, life insurance was a different matter. The main reason for this was moral. Until the end of the eighteenth century, the boundary between life insurance and mere gambling had been unclear. This was most obvious in the widespread practice in England of buying a life insurance policy on somebody other than one’s self—a soldier, a sea captain, a prominent statesman. By the end of the eighteenth century, the British had outlawed this practice; Americans soon followed suit. With this prohibition on third-party life insurance policies, the cloud of immorality that had hung over life insurance was lifted. Moralizers could no longer claim that the practice encouraged a macabre disregard for life, and underwriters could defend life insurance for its obvious humanitarian value. Now, the beneficiaries were not simply gamblers but women, children—the dependents of the deceased. With these large moral shifts, the business began to flourish.

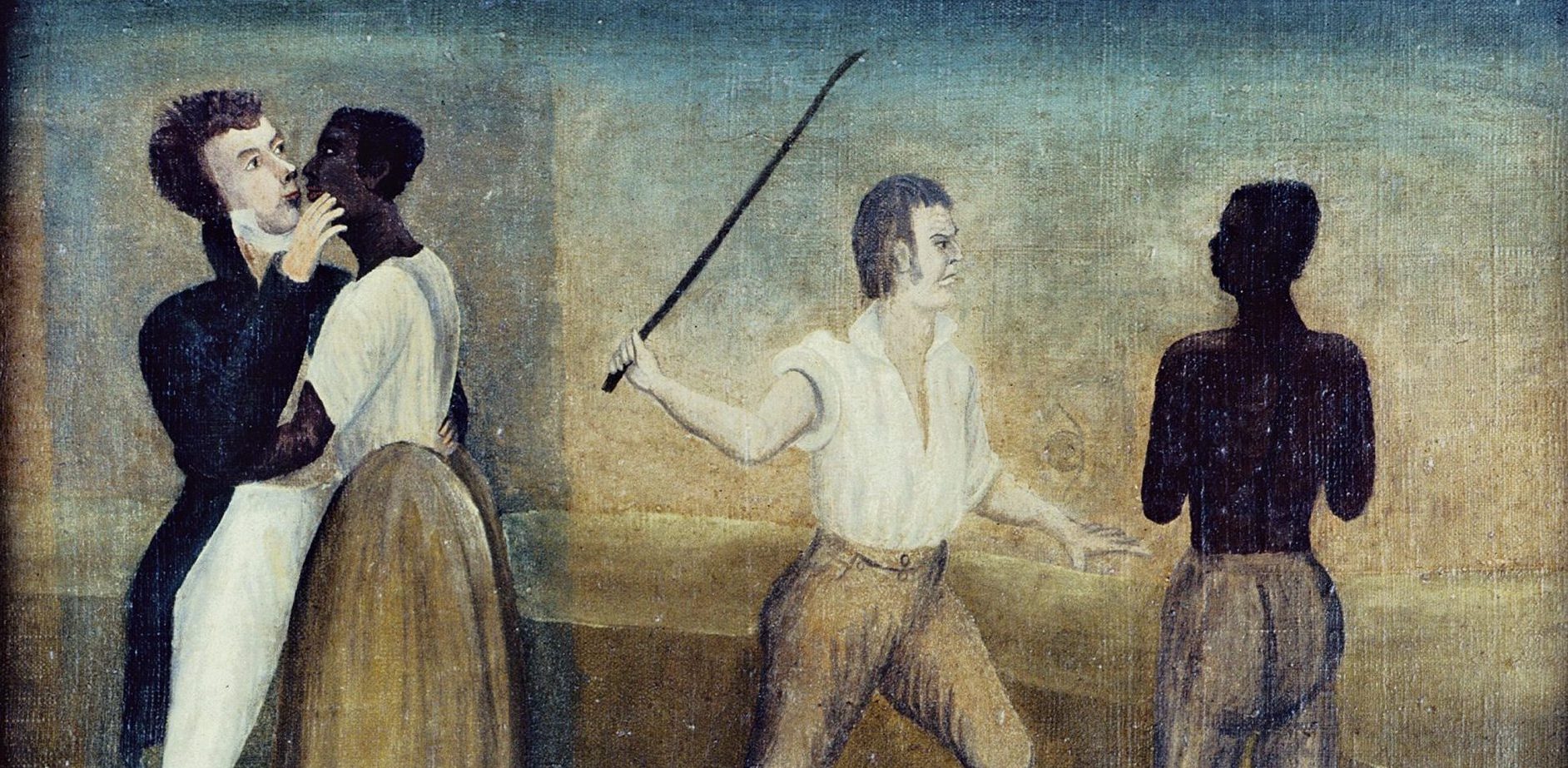

Taken together, the rise of marine, fire, and life insurance is the story of a massive but intricately articulated industry. It spread its influence across the vast geography of America and into the most intimate spaces of American lives. Insurance came to dominate not only the planning and decisions made by cities, towns, and individuals but also the deeper structural fates of various components of the American economy—from slavery to pension funds to public welfare. What that meant as a social phenomenon is manifest for an alert pedestrian looking upward in any major American city—insurance company buildings are among a modern city’s tallest, signifying in their opaque reflections a monumental bureaucratic success.

But what insurance underwriting meant in other ways, as both artifact and method, is not so obvious. How did Copson’s new marketplace of personal assurances and public insurance affect other areas of American cultural and social life? How and why did we become an underwriting nation? What cultural logic and political stratagems were at work? And what does it mean to say we are an “underwriting society”?

Part III

When one takes seriously the word “underwriting,” a more developed cultural analysis that helps to explain the power of insurance in American life becomes possible.

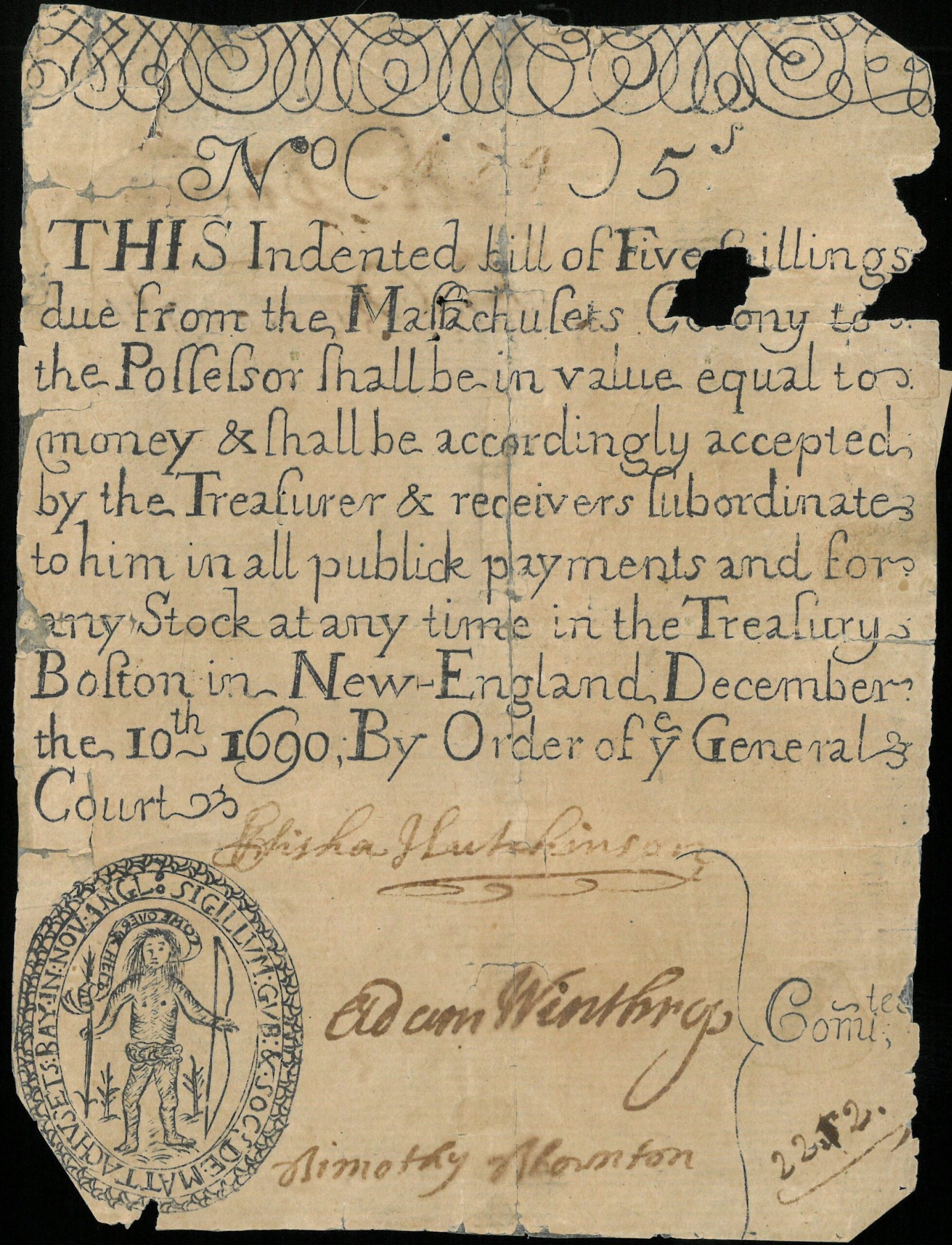

I want to end this brief essay with some speculative conceptualizations, using the idea of “underwriting” as a kind of poetics. I hope such abstract descriptions help to explain a little better the less tangible effects of America’s insurance history. First, I think it’s necessary to ask: what concepts might be said to underwrite the underwriters? To answer this question it is crucial to look to the early use of money as a practical symbol in the transatlantic sphere. Indeed, the emergence of not only new forms of money and new methods of accounting but also the concepts that made possible these monetary instruments and commercial practices reveal the complexity of value—as represented by paper, coin, credit, and assorted other instruments of worth. Literary critic Marc Shell, in Money, Language, and Thought, notes that when the uniform use of paper money as national currency began in the United States, it sparked a discussion of the critical symbolic functions of coinage and printed money. He goes on to show how historical conceptualizations of literature and money have been strangely similar. Shell’s point is equally true for insurance, a manifestation of the conceptual workings of property, text, and value.

To describe both the emergence of paper currency and the growth of insurance underwriting is to delineate in all its tenacity the determination of monetary capital to harness unreliable experience, to once and for all channel risk and instability into material (or at least textual) certainties. A major part of that delineation involves the very notion of the imaginative text. Shell posits (and indeed it is a major premise of not only Marxist and classical economic thinking about specie, commodities, and paper money but also much older theological theories of money) that the history of language and money revolve around a common problem: the creation of symbolic value (what we’ve come to call “meaning”) out of an irreducible absence.

Historian of mathematics Brian Rotman, in Signifying Nothing, shows how modern forms of money have been primed in crucial ways by the arithmetic evolution of the symbol for nothing, zero. As a concept that can be traced back to an absence in the signifying chain, money (whether coin or paper) bases its power on the introduction of the concept of zero into Western modes of economic thinking.

Money, in whatever form, presupposes a conservationist dynamic that promises an assurance of value. Economic actors—those who, in the most basic sense, are counters—form relationships with numerical hypotheses. The counting subject, John Copson’s customer for instance, must be comfortable with the idea of both wealth and debt; but, in a critical development, he does not have to accept the inevitability of loss and absence. This is where insurance appears as an important episode in the story of money’s conceptual relation to the manufacture of real values from what might seem like nothing at all.

But insurance does this in the opposite way from circulating currency. By force of artifice, printed money extracts worth from that creative idea of nothing, without which Western modes of capitalism might never have developed as powerfully as they have. Underwritten property (a form of fiduciary or entrusted money) represents, however, the obverse of this creative circuit. Insurance underwriting seeks to efface zero from the realm of material property, thus placing an artificial stabilizer on property. Rather than creating value out of nothing, it preserves value (or meaning or property). Insurance underwriting is a crucial means of assuring that money’s numbers refer to countable values that will not—indeed cannot—disappear. Copson’s customers, it would seem, got more than liability insurance or a new profit possibility—they found a new kind of stability in an increasingly doubtful world.

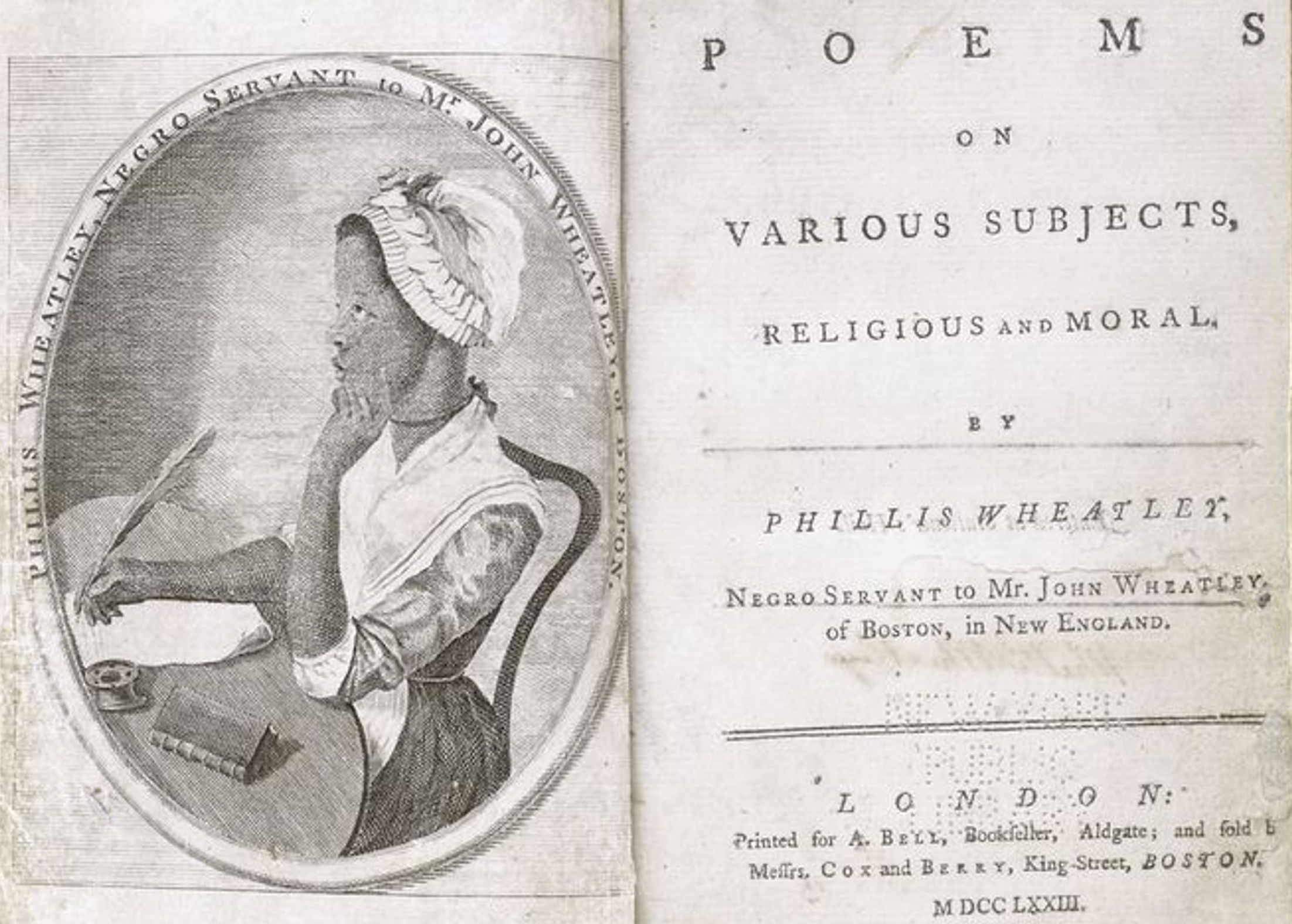

Because it is in essence a “writing business,” insurance invites comparisons and critical connections with the methods and genres of nonbusiness writing—whether dictionaries or grammars or poetic elegies, whether autobiography or advertisements for public financing or fictional responses to accidents. Thus, the questions that circulate through the history of insurance are wrought in critically productive ways in the literature of Phillis Wheatley, Ralph Waldo Emerson, and Herman Melville, as well as the textual projects of Noah Webster and, of course, Benjamin Franklin. Here the echoes of commercial life are located in tropes of loss and possession, themes of anxiety and risk, and the evolving and intricately cross-calibrated mechanics of self-mastery and genius. These authors are but strong cases in a wider cultural logic in which business discourses persistently challenge and assist literary conventions. As a practice that translates material commodities and their fate as underwriter’s contracts into real value, insurance asks us to grasp what ownership, in all its senses, might mean for American writers as well as American businessmen.

After all, when we go deeper into the cultural methods of John Copson’s economic milieu, we find not only novel ways of turning profits. Maybe more important, we find original ways of thinking about the individuals and groups that were able to realize those material gains. Here, in the underwritten colonial world, are newly visible texts of self-identity, imaginative possibility, and public expression.

Further Reading:

For the history of economic institutions, particularly insurance enterprises in colonial America, I have relied heavily on a number of histories. Among the most import are: John J. McCusker and Russell R. Menard’s, The Economy of British America, 1607-1789 (Chapel Hill, 1985): 347-48; Mary Elizabeth Ruwell’s, Eighteenth Century Capitalism: The Formation of American Marine Insurance Companies (New York, 1993); William H. Fowler, “Marine Insurance in Boston: The Early Years of the Boston Marine Insurance Company, 1799-1807,” in Conrad Edick Wright and Katheryn P. Viens, eds., Entrepreneurs: The Boston Business Community, 1700-1850 (Boston, 1997): 151-180; C. Mitchell Bradford, A Premium on Progress: An Outline History of the American Marine Insurance Market, 1820-1970 (New York, 1970); Thomas M. Doerflinger’s A Vigorous Spirit of Enterprise: Merchants and Economic Development in Revolutionary Philadelphia (Chapel Hill, 1986); and, finally, Edwin J. Perkins’s superb history, American Public Finance and Financial Services, 1700-1815 (Columbus, 1994).

For those interested in recent renditions of the relationship between economics and literature, see Martha Woodmansee’s and Mark Osteen’s collection, The New Economic Criticism: Studies at the Intersection of Literature and Economics (New York, 1999), as well as Marc Shell’s work in Art and Money (Chicago, 1995); Money, Language, and Thought: Literary and Philosophical Economies from the Medieval to the Modern Era (Baltimore, 1993); and The Economy of Literature (Baltimore, 1978).

The study of the rise of finance capital and its relationship to the novel has been especially vigorous in British eighteenth-century studies. See James Thompson, Models of Value: Eighteenth-Century Political Economy and the Novel (Durham, N.C., 1996); Colin Nicholson, Writing and the Rise of Finance: Capital Satires of the Early Eighteenth Century (Cambridge, 1994); Samuel L. Macey, Money and the Novel: Mercenary Motivation in Defoe and His Immediate Successors (Vancouver, 1983). For accounts not exclusively limited to the eighteenth century, see John Vernon, Money and Fiction: Literary Realism in the Nineteenth and Early Twentieth Centuries (Ithaca, N.Y., 1984) and Anthony Purdy, ed., Literature and Money (Atlanta, 1993).

This article originally appeared in issue 7.1 (October, 2006).

Eric Wertheimer is an associate professor of American literature at Arizona State University. His first book, Imagined Empires: Incas, Aztecs, and the New World of American Literature, 1771-1876, was published in 1998 by Cambridge University Press. The essay here is drawn from Underwriting: the Poetics of Insurance in America, 1722-1872 (2006). With Jennifer Baker, he is coediting a special issue of Early American Literature, dedicated to economic criticism in early American literary studies.